Head and Shoulders Chart Pattern Strategy

Head and Shoulders pattern is a widely recognized technical analysis formation used by traders to predict trend reversals in financial markets. This pattern is named for its visual resemblance to a head with two shoulders and is considered a reliable indicator of a potential change in price direction. In this article, we will delve into the intricacies of the Head and Shoulders pattern strategy, its components, variations, and how traders can effectively use it to make informed trading decisions.

1. Anatomy of Pattern

1. Anatomy of Pattern

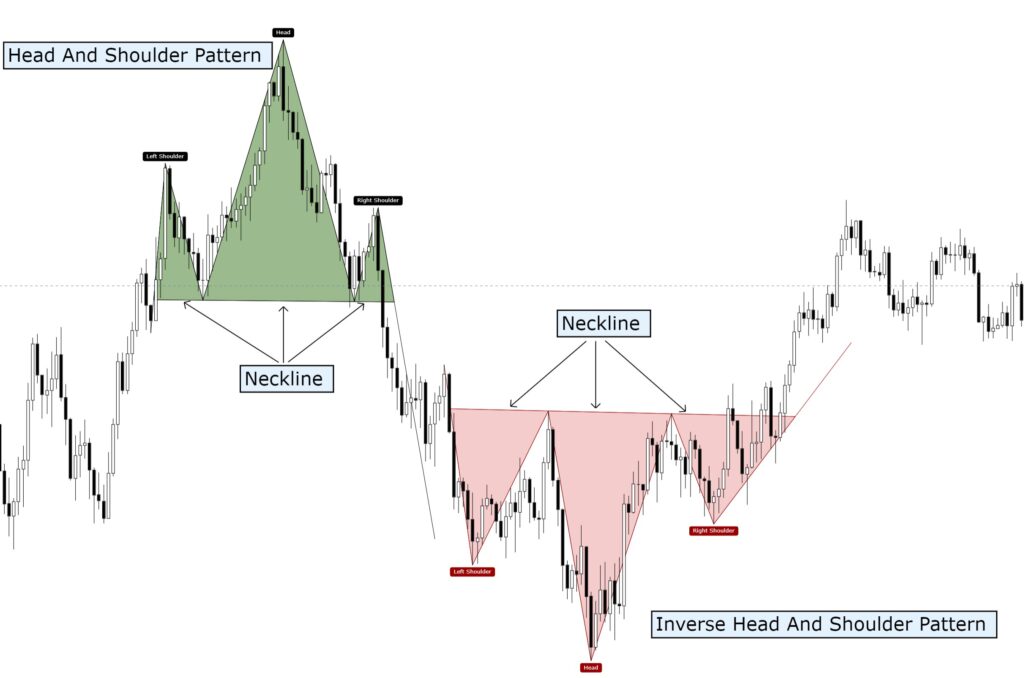

The Head and Shoulders pattern consists of three main parts:

– Left Shoulder: This forms when the price reaches a peak, followed by a decline.

– Head: The subsequent peak which is higher than the left shoulder, indicating a potential reversal after a temporary increase.

– Right Shoulder: Another peak similar in height to the left shoulder, followed by a decline that confirms the pattern.

These peaks and troughs create a distinct pattern resembling a baseline with three peaks, with the middle peak (head) being the highest.

2. Identifying Pattern

Recognition of the pattern is crucial for its effective use:

– Symmetry: The shoulders should be relatively equal in height and width, with the head being the highest point.

– Volume: Volume plays a significant role. Typically, volume is higher at the beginning of the pattern and decreases as it progresses toward the right shoulder.

– Neckline: This is a trendline connecting the low points of the left shoulder, head, and right shoulder. The breakout below this neckline confirms the pattern.

3. Types of Head and Shoulders Patterns

– Inverse Head and Shoulders: This is a bullish reversal pattern where the inverse of the Head and Shoulders pattern appears, indicating a potential upward trend.

– Inverse Head and Shoulders: This is a bullish reversal pattern where the inverse of the Head and Shoulders pattern appears, indicating a potential upward trend.

– Complex Head and Shoulders: Sometimes the pattern may have multiple shoulders or a less defined structure, making it more complex to identify.

– Complex Head and Shoulders: Sometimes the pattern may have multiple shoulders or a less defined structure, making it more complex to identify.

4. Trading Strategies Using the Head and Shoulders Pattern

– Entry Points: Traders typically enter short positions when the price breaks below the neckline after the right shoulder is formed. For an inverse Head and Shoulders, entry occurs after the neckline is breached upwards.

– Stop-Loss: Placing a stop-loss just above the right shoulder for a standard Head and Shoulders pattern, or below the right shoulder for an inverse pattern, helps manage risk.

– Profit Targets: The pattern allows traders to set profit targets based on the distance between the head and the neckline, projected downwards for standard Head and Shoulders, or upwards for the inverse pattern.

5. Considerations and Limitations: Head and Shoulders Chart Pattern Strategy

– Confirmation: Wait for confirmation of the pattern through volume and price action before entering a trade.

– False Signals: Like any technical indicator, the Head and Shoulders pattern is not foolproof and can result in false signals.

– Market Conditions: Consider broader market trends and economic factors that may influence the reliability of the pattern.

6. Example and Application: Head and Shoulders Chart Pattern Strategy

Let’s consider an example where a stock exhibits a Head and Shoulders pattern after a prolonged uptrend. Traders observe the formation of the left shoulder, head, and right shoulder, followed by a breakout below the neckline. This signals a potential trend reversal, prompting traders to enter short positions with appropriate risk management strategies in place.

Conclusion

The Head and Shoulders pattern is a valuable tool in the technical analyst’s toolkit, providing insights into potential trend reversals and entry points for trades. By understanding its components, variations, and application strategies, traders can enhance their ability to make informed decisions in dynamic market environments. However, it is essential to combine pattern recognition with other forms of analysis and risk management techniques to maximize its effectiveness and mitigate potential risks associated with false signals.

In summary, mastering the Head and Shoulders pattern requires practice, patience, and a thorough understanding of its nuances. When used judiciously, this pattern can be a powerful ally in navigating the complexities of financial markets.